COMMERCIAL LOAN PROGRAMS

Harbor Equity is a US based, private money lender. We are known for our accommodating, common sense and time saving approach to underwriting, while still offering efficient, hassle-free loan programs.

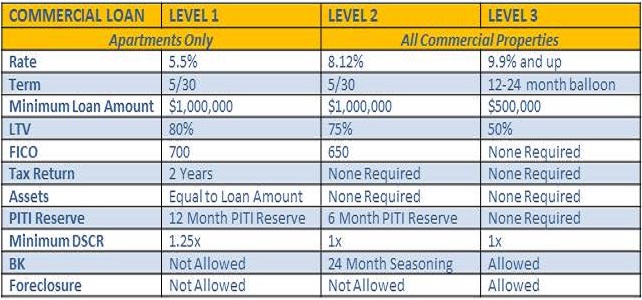

Below are our 3 main programs for Office, Retail, Raw Land, Developments, Apartment and Industrial properties:

CLICK HERE TO DOWNLOAD TABLE

COMMERCIAL HARD MONEY

Are you looking to purchase commercial property but are having difficulty getting approved for financing using conventional financing? Harbor Equity offers commercial hard money lending with great rates and terms. We understand that specific circumstances or events can make it difficult for conventional financing which is why we offer the best rates on commercial hard money lending.

A hard money loan is a specific type of assert-based loan financing that comes from private investors or companies. While interest rates are typically higher than conventional commercial property loans, it can be a great option for those that are looking for shorter duration loans or that have extraneous situations that prevent conventional commercial loan financing.

Most hard money loans are used for short term projects lasting from a few months to a few years and can be especially valuable when fast closings are important. Call us now to schedule your commercial hard money loan consultation with Harbor Equity.

BRIDGE LOANS

Harbor Equity offers both residential and commercial bridge loans. Bridge loans are great for real estate situations where the buyer of the property does not want to make a contingency offer, helping make your offer more appealing to the seller of the property you wish to purchase.

A bridge loan is a temporary loan that ‘bridges’ the gap between the sales price of the new property and the buyer’s new mortgage when the buyer’s existing property has not sold. This enables you to purchase your new property without a contingency offer. In a seller’s market, the cleaner your offer is, the more likely it is for you to have your offer accepted.

Schedule your bridge loan consultation with Harbor Equity. Let us get into the new property that you have been looking at by helping you avoid a contingency offer.

CONSTRUCTION LOANS

Traditional mortgages and conventional financing are often not available to property owners because the loan is based off of a structure that does not yet exist. A construction loan is typically a short term loan that is used to pay for the cost of building a home, office, or structure. This enables property owners to finance the cost of building the property and at the completion of the construction, property owners then can pay off the construction loan with traditional financing, a conventional mortgage, or an “end loan”.

Construction Loans are paid off at the end of the construction when you essentially refinance your property now that the structure has been completed. Harbor Equity offers construction loans to property owners that are seeking financing but have failed to get approved through conventional methods.

RAW LAND LOANS

Almost any construction and development of property or expansion starts with the acquisition of new raw land. Harbor Equity offers raw land loans to applicants seeking raw land for development, construction or resale. We’ve got competitive rates on raw land loans and can help you get approved so you can be underway with your project.

Raw land loans are more complicated than traditional real estate loans because the collateral on the loan in the immediate presence is the raw land. Conventional financing often cannot be approved because banks do not want to be left with land that they cannot get rid of should the borrower walk from the property. Discuss your raw land loan needs by scheduling your consultation with Harbor Equity.

WORKOUTS LOANS

Harbor Equity offers loan workouts to individuals that have found themselves in a foreclosure situation that are looking to get back on track with their payments. A loan workout is a plan of how to restructure debt in the face of foreclosure as an alternative to having assets seized in the event you do foreclose.

In a workout loan, Harbor Equity will determine why the borrower was unable to repay the loan and what the likelihood is that the borrower will be able to make payments on the new terms. This involves understanding the nature of the hardship that the borrower has faced, the amount left on the existing loan, how much equity has been earned in the property, and future financial prospects.

Borrowers that are facing foreclosure that are looking to get back on track and make payments on their property can investigate if workout loans are right for them.

“We say YES when banks say no.”